Latest News

Stocks retreated on Friday as Big Tech remained under pressure, with the Dow and Nasdaq shedding triple digits and marking a third-straight weekly loss.

Via Talk Markets · January 30, 2026

Cricut designs and sells consumer cutting machines, accessories, and digital content that enable craft, design, and small-scale production projects.

Via Talk Markets · January 30, 2026

Lean hog futures saw weaker Friday trade, with contracts down 30 to 45 cents in the nearbys. February was down $1.10 this week. USDA’s national base hog price was reported at $83.57 on Friday afternoon, down 81 cents from the previous day. The CME Le...

Via Barchart.com · January 30, 2026

Soybeans posted weakness to close out Friday, with contracts 8 to 10 cents in the red. That pushed March lower on the week by 3 ½ cents. The cmdtyView national average Cash Bean price was 7 1/2 cents lower at $9.98 1/2. Soymeal futures were $2.40 to...

Via Barchart.com · January 30, 2026

PLX Shares Jump 13% On EMA Committee’s Turnaround On New Dosing Regimen For Fabry Disease Therapystocktwits.com

Via Stocktwits · January 30, 2026

Disney CEO Bob Iger Reportedly Plans to Leave His Role Before Contract Expiresstocktwits.com

Via Stocktwits · January 30, 2026

Corn futures closed the Friday session with contracts pulling off midday lows but still down 2 to 4 cents. March was down 2 ¼ cents this week. The CmdtyView national average Cash Corn price was down 2 cents at $3.93 1/4. Outside markets played a role...

Via Barchart.com · January 30, 2026

Cotton futures posted losses of 30 to 46 points on Friday, with March down 64 points this week. Crude oil futures were up $0.32 per barrel on the day at $64.74. The US dollar index was back up $0.893 to $97.030. Friday’s Commitment of Traders report...

Via Barchart.com · January 30, 2026

The wheat complex gave into weakness on Friday, as a $0.893 gain in the dollar index added some pressure. Chicago SRW futures saw 3 to 4 ¼ cent losses on the day, as March was up 8 ½ cents on the week. KC HRW futures were down 2 to 3...

Via Barchart.com · January 30, 2026

Live cattle futures were weaker on Friday, as most contracts fell 47 cents to $1.75. February was an exception, up 35 cents on cash strength, with the weekly move +95 cents. Cash trade settled in at $238-240 live across the country and $375-378 dress...

Via Barchart.com · January 30, 2026

The company has secured relatively cheap debt financing.

Via The Motley Fool · January 30, 2026

This fintech stock just posted a huge 62% gain in 2025.

Via The Motley Fool · January 30, 2026

Software was eating the world in the early 2010s. Is AI eating software today?

Via The Motley Fool · January 30, 2026

The booming artificial intelligence (AI) infrastructure business has been a fantastic investment.

Via The Motley Fool · January 30, 2026

The franchise model holds up well in today's restaurant environment.

Via The Motley Fool · January 30, 2026

In the short run, the market is a voting machine, but in the long run, it is a weighing machine.

Via The Motley Fool · January 30, 2026

According to a report from Reuters, Bowman voted to hold monetary policy steady so as to gather additional data before voting next.

Via Stocktwits · January 30, 2026

Apple’s earnings confirmed resilient demand and record-breaking iPhone sales, while investor attention quickly shifts to supply constraints and the company’s evolving AI strategy.

Via The Motley Fool · January 30, 2026

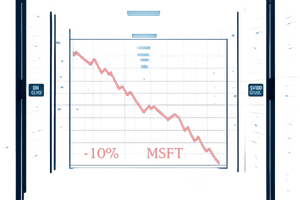

The dip in MSFT stock appears to be overdone. This is why value investors can look into various strategy plays.

Via Talk Markets · January 30, 2026

Gold’s record plunge as precious metals and growth stocks pull back today, Jan. 30, 2026.

Via The Motley Fool · January 30, 2026

The data security firm saw its stock price plummet 33% on Tuesday.

Via The Motley Fool · January 30, 2026

On January 27, 2026, Boeing (NYSE: BA) released its fourth-quarter and full-year 2025 financial results, marking what many analysts are calling a "credibility reset" for the storied aerospace giant. For the first time since 2018, the company reported a positive annual net income, signaling an end to the multi-year spiral

Via MarketMinute · January 30, 2026

XPeng Inc. designs and manufactures smart electric vehicles for tech-focused Chinese consumers, with $10.15B in annual revenue.

Via The Motley Fool · January 30, 2026

The Platinum Moat: American Express Projects Record 2026 Profits as High-End Spending Defies Economic Gravity

On January 30, 2026, American Express (NYSE:AXP) delivered a powerful signal of confidence to the financial markets, issuing a robust 2026 profit forecast that comfortably exceeded Wall Street’s expectations. Despite a minor earnings-per-share

Via MarketMinute · January 30, 2026

It's absolutely the right time to be in the digital storage business.

Via The Motley Fool · January 30, 2026

AUSTIN, TX — In a move that could redefine the global technology and aerospace landscape, reports have surfaced that Elon Musk is considering a massive corporate consolidation, potentially merging the private aerospace giant SpaceX with either Tesla (NASDAQ: TSLA) or his rapidly growing AI startup, xAI. The rumors, which reached a

Via MarketMinute · January 30, 2026

As the final trading day of January 2026 draws to a close, North American markets are grappling with a renewed surge in trade-related volatility. On January 30, 2026, shares of Bombardier Inc. (TSX: BBD.B) plunged by over 7% following a direct broadside from the White House, marking a sharp

Via MarketMinute · January 30, 2026

Via Benzinga · January 30, 2026

The appliance giant Whirlpool Corporation (NYSE:WHR) saw its shares plummet by 10% on January 30, 2026, following a fourth-quarter earnings report that missed analyst expectations on nearly every key metric. The steep decline reflects growing investor anxiety over a "challenging" consumer environment defined by stubbornly high mortgage rates and

Via MarketMinute · January 30, 2026

It was never supposed to be your whole retirement plan.

Via The Motley Fool · January 30, 2026

In a jarring disconnect between fiscal performance and market sentiment, ServiceNow (NYSE: NOW) saw its shares crater by nearly 10% on January 29, 2026, despite delivering a Fourth Quarter 2025 report that exceeded analyst expectations on every major metric. The enterprise software giant, long considered a bellwether for the digital

Via MarketMinute · January 30, 2026

Mastercard Incorporated (NYSE: MA) reported a significant earnings beat for the fourth quarter of 2025, sending its stock price climbing over 2% in early trading on January 30, 2026. The financial services giant outperformed Wall Street expectations on both the top and bottom lines, fueled by a sustained resilience in

Via MarketMinute · January 30, 2026

SAN FRANCISCO — In a financial climate marked by fluctuating consumer sentiment and persistent inflationary pressures, payments giant Visa Inc. (NYSE: V) has once again demonstrated its role as a cornerstone of the global economy. Reporting its fiscal first-quarter 2026 results on January 29, the company posted better-than-expected revenue and earnings,

Via MarketMinute · January 30, 2026

Via MarketBeat · January 30, 2026

International Business Machines (NYSE: IBM) has stunned Wall Street with a powerhouse fourth-quarter earnings report that sent its stock price soaring by more than 10% in the days following the release. As of January 30, 2026, the tech giant’s shares have reached multi-year highs, trading near the $315 mark—

Via MarketMinute · January 30, 2026

/AI%20(artificial%20intelligence)/Businessman%20work%20with%20ai%20for%20economy%20analysis%20financial%20result%20by%20digital%20augmented%20reality%20graph%20by%20Natee%20K%20Jindakum%20via%20Shutterstock.jpg)

Mizuho still sees upside in AMAT stock despite its massive 52-week return.

Via Barchart.com · January 30, 2026

DALLAS — Shares of Southwest Airlines (NYSE: LUV) surged 5% in early trading following the company’s release of its fourth-quarter 2025 financial results and an unexpectedly aggressive profit forecast for 2026. The Dallas-based carrier, which has spent the last year undergoing the most radical transformation in its 53-year history, told

Via MarketMinute · January 30, 2026

GameStop shares moved higher after CEO Ryan Cohen outlined plans for a major acquisition, with investor Michael Burry adding to his stake and backing the strategy.

Via Talk Markets · January 30, 2026

NEW YORK – In a week that will likely be remembered as one of the most volatile in the history of commodities trading, precious metals have undergone a violent "flash correction" that has left investors reeling. After a parabolic ascent that saw Gold shatter the $5,500 per ounce ceiling and

Via MarketMinute · January 30, 2026

In a year marked by a significant "lower for longer" pricing environment and shifting global energy dynamics, Chevron Corporation (NYSE: CVX) reported a resilient fourth-quarter 2025 performance that exceeded analyst expectations on the bottom line. Despite facing a sharp decline in average Brent crude prices—averaging $69 per barrel in

Via MarketMinute · January 30, 2026

This small-cap Trump stock has announced a $100 million share buyback program. Here's what investors should know.

Via Barchart.com · January 30, 2026

IRVING, TX — In a display of operational muscle that has become the hallmark of its post-merger era, Exxon Mobil Corporation (NYSE:XOM) reported fourth-quarter 2025 earnings today that comfortably cleared Wall Street’s hurdles. Despite a challenging environment characterized by a nearly 20% year-over-year slide in global crude prices and

Via MarketMinute · January 30, 2026

Reports surfaced this week that Amazon.com, Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI, the world’s leading artificial intelligence laboratory. This potential deal, first reported by major financial outlets on January 29, 2026, marks a seismic shift in the "AI Arms

Via MarketMinute · January 30, 2026

It's presently selling into one of the most lively segments of the tech sphere.

Via The Motley Fool · January 30, 2026

In a week that many analysts are calling a "watershed moment" for the future of transportation and artificial intelligence, Tesla (NASDAQ:TSLA) reported fourth-quarter 2025 earnings that defied the grim expectations of the "EV winter." On January 28, 2026, the company posted a non-GAAP earnings per share (EPS) of $0.

Via MarketMinute · January 30, 2026

Neither investors nor analysts seemed very impressed by the equipment rental company's recent performance.

Via The Motley Fool · January 30, 2026

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

Artificial intelligence isn't performing surgery yet, but if (when?) it does, these two companies are likely to be at the heart of it.

Via The Motley Fool · January 30, 2026