Latest News

It's absolutely the right time to be in the digital storage business.

Via The Motley Fool · January 30, 2026

AUSTIN, TX — In a move that could redefine the global technology and aerospace landscape, reports have surfaced that Elon Musk is considering a massive corporate consolidation, potentially merging the private aerospace giant SpaceX with either Tesla (NASDAQ: TSLA) or his rapidly growing AI startup, xAI. The rumors, which reached a

Via MarketMinute · January 30, 2026

As the final trading day of January 2026 draws to a close, North American markets are grappling with a renewed surge in trade-related volatility. On January 30, 2026, shares of Bombardier Inc. (TSX: BBD.B) plunged by over 7% following a direct broadside from the White House, marking a sharp

Via MarketMinute · January 30, 2026

Disney CEO Bob Iger Reportedly Plans to Leave His Role Before Contract Expiresstocktwits.com

Via Stocktwits · January 30, 2026

Aduro Clean Technologies Announces Closing of Underwriter’s Over-Allotment Option in Public Offeringstocktwits.com

Via Stocktwits · January 30, 2026

Via Benzinga · January 30, 2026

The appliance giant Whirlpool Corporation (NYSE:WHR) saw its shares plummet by 10% on January 30, 2026, following a fourth-quarter earnings report that missed analyst expectations on nearly every key metric. The steep decline reflects growing investor anxiety over a "challenging" consumer environment defined by stubbornly high mortgage rates and

Via MarketMinute · January 30, 2026

It was never supposed to be your whole retirement plan.

Via The Motley Fool · January 30, 2026

In a jarring disconnect between fiscal performance and market sentiment, ServiceNow (NYSE: NOW) saw its shares crater by nearly 10% on January 29, 2026, despite delivering a Fourth Quarter 2025 report that exceeded analyst expectations on every major metric. The enterprise software giant, long considered a bellwether for the digital

Via MarketMinute · January 30, 2026

Mastercard Incorporated (NYSE: MA) reported a significant earnings beat for the fourth quarter of 2025, sending its stock price climbing over 2% in early trading on January 30, 2026. The financial services giant outperformed Wall Street expectations on both the top and bottom lines, fueled by a sustained resilience in

Via MarketMinute · January 30, 2026

SAN FRANCISCO — In a financial climate marked by fluctuating consumer sentiment and persistent inflationary pressures, payments giant Visa Inc. (NYSE: V) has once again demonstrated its role as a cornerstone of the global economy. Reporting its fiscal first-quarter 2026 results on January 29, the company posted better-than-expected revenue and earnings,

Via MarketMinute · January 30, 2026

Via MarketBeat · January 30, 2026

Via Benzinga · January 30, 2026

International Business Machines (NYSE: IBM) has stunned Wall Street with a powerhouse fourth-quarter earnings report that sent its stock price soaring by more than 10% in the days following the release. As of January 30, 2026, the tech giant’s shares have reached multi-year highs, trading near the $315 mark—

Via MarketMinute · January 30, 2026

/AI%20(artificial%20intelligence)/Businessman%20work%20with%20ai%20for%20economy%20analysis%20financial%20result%20by%20digital%20augmented%20reality%20graph%20by%20Natee%20K%20Jindakum%20via%20Shutterstock.jpg)

Mizuho still sees upside in AMAT stock despite its massive 52-week return.

Via Barchart.com · January 30, 2026

DALLAS — Shares of Southwest Airlines (NYSE: LUV) surged 5% in early trading following the company’s release of its fourth-quarter 2025 financial results and an unexpectedly aggressive profit forecast for 2026. The Dallas-based carrier, which has spent the last year undergoing the most radical transformation in its 53-year history, told

Via MarketMinute · January 30, 2026

GameStop shares moved higher after CEO Ryan Cohen outlined plans for a major acquisition, with investor Michael Burry adding to his stake and backing the strategy.

Via Talk Markets · January 30, 2026

NEW YORK – In a week that will likely be remembered as one of the most volatile in the history of commodities trading, precious metals have undergone a violent "flash correction" that has left investors reeling. After a parabolic ascent that saw Gold shatter the $5,500 per ounce ceiling and

Via MarketMinute · January 30, 2026

In a year marked by a significant "lower for longer" pricing environment and shifting global energy dynamics, Chevron Corporation (NYSE: CVX) reported a resilient fourth-quarter 2025 performance that exceeded analyst expectations on the bottom line. Despite facing a sharp decline in average Brent crude prices—averaging $69 per barrel in

Via MarketMinute · January 30, 2026

This small-cap Trump stock has announced a $100 million share buyback program. Here's what investors should know.

Via Barchart.com · January 30, 2026

IRVING, TX — In a display of operational muscle that has become the hallmark of its post-merger era, Exxon Mobil Corporation (NYSE:XOM) reported fourth-quarter 2025 earnings today that comfortably cleared Wall Street’s hurdles. Despite a challenging environment characterized by a nearly 20% year-over-year slide in global crude prices and

Via MarketMinute · January 30, 2026

Reports surfaced this week that Amazon.com, Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI, the world’s leading artificial intelligence laboratory. This potential deal, first reported by major financial outlets on January 29, 2026, marks a seismic shift in the "AI Arms

Via MarketMinute · January 30, 2026

It's presently selling into one of the most lively segments of the tech sphere.

Via The Motley Fool · January 30, 2026

In a week that many analysts are calling a "watershed moment" for the future of transportation and artificial intelligence, Tesla (NASDAQ:TSLA) reported fourth-quarter 2025 earnings that defied the grim expectations of the "EV winter." On January 28, 2026, the company posted a non-GAAP earnings per share (EPS) of $0.

Via MarketMinute · January 30, 2026

Neither investors nor analysts seemed very impressed by the equipment rental company's recent performance.

Via The Motley Fool · January 30, 2026

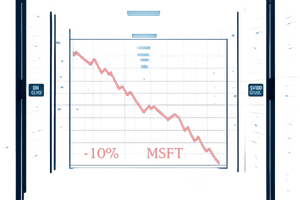

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

Artificial intelligence isn't performing surgery yet, but if (when?) it does, these two companies are likely to be at the heart of it.

Via The Motley Fool · January 30, 2026

The company shut the lid on 2025 by posting a mixed final quarter.

Via The Motley Fool · January 30, 2026

MENLO PARK, CA — In a resounding validation of its aggressive pivot toward artificial intelligence, Meta Platforms (NASDAQ:META) saw its stock price skyrocket by 9% in late January 2026. The surge followed a blowout fourth-quarter earnings report that silenced critics of the company’s massive capital expenditure and established the

Via MarketMinute · January 30, 2026

Apple Inc. (NASDAQ: AAPL) delivered a commanding performance in its fiscal first-quarter earnings report on January 29, 2026, shattering revenue and profit records on the back of explosive demand for the iPhone 17. Despite exceeding analyst expectations across nearly every major metric, the tech giant saw its stock price decline

Via MarketMinute · January 30, 2026

The financial markets were jolted on January 30, 2026, as the Bureau of Labor Statistics (BLS) released Producer Price Index (PPI) data for December 2025 that was significantly "warmer" than any analyst had predicted. Headline PPI rose 0.5% month-over-month, more than double the consensus estimate of 0.2%, while

Via MarketMinute · January 30, 2026

In a move that sent immediate shockwaves through global financial markets, President Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on the morning of January 30, 2026, represents a fundamental shift in the leadership

Via MarketMinute · January 30, 2026

Via Benzinga · January 30, 2026

What's going on in today's after hours sessionchartmill.com

Via Chartmill · January 30, 2026

NextEra Energy combines utility stock stability with renewable energy upside.

Via The Motley Fool · January 30, 2026

Intel is back in focus as Apple reportedly looks to use its U.S. foundries, sparking fresh debate over whether INTC stock is worth buying now.

Via Barchart.com · January 30, 2026

Via Benzinga · January 30, 2026

Webull Corporation delivers digital trading and wealth management tools for retail investors in the online brokerage sector.

Via The Motley Fool · January 30, 2026

Musk weighs empire-wide mergers as dealmaking heats up across tech, sports, retail, AI, private equity, and bankruptcy restructurings.

Via Benzinga · January 30, 2026

OpenAI and Anthropic are expected to have IPOs in 2026, potentially driving up AI infrastructure spending and benefiting companies like Nvidia, Amazon, and Microsoft.

Via Benzinga · January 30, 2026

The company reported revenue of $3.02 billion for the quarter, 25% higher compared to the same period last year, and above analyst estimates of $2.9 billion.

Via Stocktwits · January 30, 2026

The memory shortage got a lot of attention on Apple's earnings call.

Via The Motley Fool · January 30, 2026

OnlyFans a deal that would value the company at $5.5 billion when factoring in its existing debt — and a potential IPO.

Via Benzinga · January 30, 2026

Disney is set to report its next quarterly earnings on Feb. 2. Here's what to know ahead of that report.

Via Barchart.com · January 30, 2026