iShares S&P 500 Growth ETF (IVW)

97.06

-0.12 (-0.12%)

NYSE · Last Trade: May 11th, 6:24 PM EDT

A new signal is showing up all over the market, warning investors that the worst might not be over yet for the S&P 500 and the economy.

Via MarketBeat · May 7, 2025

The company’s Q1 revenue missed estimates, and net profit declined due to higher staff costs and write-offs.

Via Stocktwits · May 2, 2025

The purchase comes just after share sales by CEO Brian Chesky and other insiders.

Via Stocktwits · April 23, 2025

There are several good ones to choose from, but current circumstances make one fund in particular stand out.

Via The Motley Fool · April 11, 2025

It doesn't take deep pockets to build a diversified growth portfolio.

Via The Motley Fool · April 5, 2025

Forget trying to pick the stock market's next big winners. Just hold a piece of all its best prospects.

Via The Motley Fool · March 21, 2025

Including the latest transaction, Brian Chesky has reportedly offloaded a stake worth at least $92.5 million across several transactions this year.

Via Stocktwits · March 20, 2025

In 2025, investors are shunning the largest market cap growth and highest-beta stocks and moving into value, particularly large-cap value.

Via Talk Markets · March 19, 2025

An options trader made a big bet that the S&P 500 could recover some of the declines it posted last week, with other factors at play to back it.

Via MarketBeat · March 4, 2025

A simpler strategy may also ultimately be a more fruitful one.

Via The Motley Fool · February 22, 2025

With the great returns of the S&P 500 in recent months, investors looking for something more from the index have two trending ETFs to consider.

Via MarketBeat · February 21, 2025

After a recent episode of volatility in the stock market, there is one clear sign of where opportunities may still lie for investors.

Via MarketBeat · February 13, 2025

Recent price action in banking stocks led investors to a couple of conclusions about the United States economy and where the opportunity might be.

Via MarketBeat · February 11, 2025

As volatility returns to the market, it becomes clear where traders are looking for safety measures, driving investors to these safe stocks.

Via MarketBeat · February 5, 2025

As the value stocks spread to growth stocks reach a cyclical low, it becomes clear for investors where opportunities might be found.

Via MarketBeat · February 3, 2025

These are the main themes taking over the markets in 2025, ones that investors should consider when aligning their portfolios.

Via MarketBeat · December 26, 2024

Now that the value vs. growth spreads are bottoming at multi-year lows, investors should start considering potential buys in this value list.

Via MarketBeat · December 23, 2024

As value stocks underperform growth stocks the most over a multi-year period, oil stocks might become a potential buy in the coming months.

Via MarketBeat · December 18, 2024

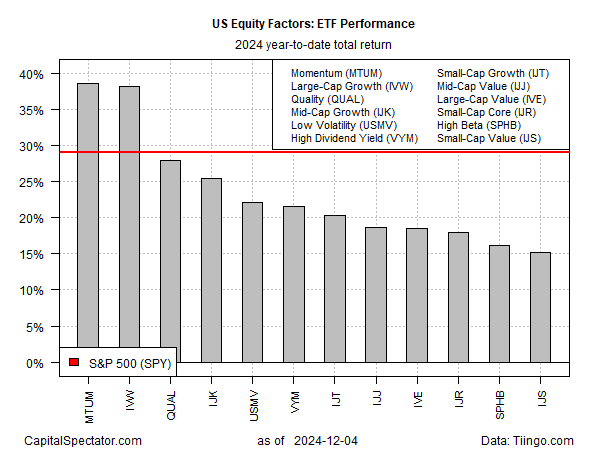

The winners keep on winning. That sums up the horse race for much of this year based on a set of ETFs targeting the main US equity factor risk premiums.

Via Talk Markets · December 5, 2024

As inflation risks for the United States economy come back online, the trade for a yield curve steepening becomes the best alternative for investors to watch

Via MarketBeat · October 30, 2024

These are the top investment trends for investors to consider in the coming quarters, primarily through the price action in these different asset classes.

Via MarketBeat · October 29, 2024

Ray-Ban Meta glasses are the top-selling product in 60% of European stores, driving significant sales for parent company EssilorLuxottica.

Via Benzinga · October 22, 2024

Microsoft to launch autonomous AI agents for businesses in November, streamlining enterprise functions and boosting efficiency.

Via Benzinga · October 21, 2024

Don't make it complicated -- and don't make time-based assumptions.

Via The Motley Fool · October 20, 2024

Production delays for Nvidia's Blackwell chips until 2025 have prompted Amazon Web Services & Dell to wait for bulk volumes, impacting their plans.

Via Benzinga · October 18, 2024