SolarEdge Technologies, Inc. - Common Stock (SEDG)

39.38

+0.00 (0.00%)

NASDAQ · Last Trade: Feb 24th, 6:51 AM EST

As of February 23, 2026, SolarEdge Technologies (NASDAQ: SEDG) finds itself at a pivotal crossroads. After a tumultuous 2024 and 2025 characterized by massive inventory gluts, leadership transitions, and a grueling restructuring process, the company is emerging as a leaner, more resilient player in the global renewable energy landscape. Today’s market focus is squarely on [...]

Via Finterra · February 23, 2026

SolarEdge stock is up more than 30% in the 2026 stock market and analysts see data center opportunities for the solar company.

Via Investor's Business Daily · February 23, 2026

Stocks in the $10-50 range offer a sweet spot between affordability and stability as they’re typically more established than penny stocks.

But their headline prices don’t guarantee quality, and investors should exercise caution as some have shaky business models.

Via StockStory · February 22, 2026

SolarEdge Technologies Inc (NASDAQ:SEDG) Posts Narrower-Than-Expected Loss, Shifts to Offensive Strategy for 2026chartmill.com

Via Chartmill · February 18, 2026

Shares of solar power systems company SolarEdge (NASDAQ:SEDG)

jumped 10% in the morning session after the company reported strong fourth-quarter results that showed higher revenue and improved margins.

Via StockStory · February 20, 2026

SolarEdge Technologies Inc (NASDAQ:SEDG) shares are trading higher on Friday. The Nasdaq is up 0.71% while the S&P 500 has gained 0.38%.

Via Benzinga · February 20, 2026

Solar power systems company SolarEdge (NASDAQ:SEDG) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 70.9% year on year to $335.4 million. Guidance for next quarter’s revenue was optimistic at $305 million at the midpoint, 3% above analysts’ estimates. Its non-GAAP loss of $0.14 per share was 39% above analysts’ consensus estimates.

Via StockStory · February 19, 2026

The company reported revenues of $335.4 million, down 1.4% from $340.2 million in the prior quarter.

Via Stocktwits · February 18, 2026

Solar power systems company SolarEdge (NASDAQ:SEDG) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 70.9% year on year to $335.4 million. Guidance for next quarter’s revenue was optimistic at $305 million at the midpoint, 3% above analysts’ estimates. Its non-GAAP loss of $0.14 per share was 39% above analysts’ consensus estimates.

Via StockStory · February 18, 2026

Solar power systems company SolarEdge (NASDAQ:SEDG)

will be announcing earnings results this Wednesday before market open. Here’s what to look for.

Via StockStory · February 16, 2026

Industrials businesses quietly power the physical things we depend on, from cars and homes to e-commerce infrastructure. They are also bound to benefit from a friendlier regulatory environment with the Trump administration,

and this excitement has led to a six-month gain of 18.8% for the sector - higher than the S&P 500’s 7.3% return.

Via StockStory · February 12, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices. This rally was fueled by a recovery in technology stocks and a significant bounce in Bitcoin, which stabilized after losing over half its value from its October peak. Investor sentiment was also lifted by a surprising improvement in U.S. consumer sentiment and the realization that massive AI-related capital expenditure, such as Amazon's planned $200 billion, directly benefits chipmakers like Nvidia and Broadcom. These "pick-and-shovel" winners jumped as much as 7%, helping the S&P 500 edge back into positive territory for 2026.

The highlight of the day was the Dow Jones Industrial Average, which surged and crossed the historic 50,000 threshold for the first time.

Via StockStory · February 6, 2026

As of February 5, 2026, Enphase Energy, Inc. (NASDAQ: ENPH) stands at a pivotal crossroads in the global energy transition. Once the undisputed "darling" of the solar sector during the early 2020s, the Fremont, California-based company is currently navigating the aftermath of a massive industry-wide inventory correction and a significant shift in the California regulatory [...]

Via Finterra · February 5, 2026

Sunrun’s stock has gained nearly 13% so far this year, building on the 98% jump in 2025 as the company’s solar products see steady demand.

Via Stocktwits · February 4, 2026

ENPH lagged SEDG all of last year, but analysts are seeing brighter prospects for Enphase due to its storage battery edge.

Via Stocktwits · February 3, 2026

A number of stocks jumped in the afternoon session after the US president announced a framework for a future deal with Greenland. Wall Street saw a broad-based rally, with the S&P 500 gaining 1.2% as investor concerns over global trade tensions eased. The positive sentiment followed an announcement that reversed course on plans to impose tariffs linked to Greenland, which had caused steep market losses earlier in the week. This recovery reflected renewed optimism in the market, as the threat of a widening trade conflict appeared to subside, encouraging investors to move back into equities.

Via StockStory · January 22, 2026

Did clean energy's 47% run signal a breakout last year?

Via The Motley Fool · January 21, 2026

SolarEdge’s 17.6% return over the past six months has outpaced the S&P 500 by 7.5%, and its stock price has climbed to $33.91 per share. This run-up might have investors contemplating their next move.

Via StockStory · January 18, 2026

As of January 16, 2026, Enphase Energy, Inc. (NASDAQ: ENPH) stands at a critical crossroads between its legacy as a residential solar pioneer and its future as a cornerstone of the global electrification and AI-driven energy transition. Once the darling of the "green premium" investment era, Enphase has spent the last 24 months navigating a [...]

Via Finterra · January 16, 2026

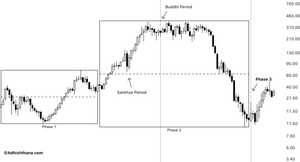

SolarEdge Technologies has been one of the sector's biggest laggards. Our analysis explains how an early structural deviation led to the stock's prolonged collapse and what lies ahead.

Via Benzinga · January 16, 2026

Via Benzinga · January 15, 2026

Shares of solar power systems company SolarEdge (NASDAQ:SEDG)

jumped 9.1% in the afternoon session after its positive momentum continued as TD Cowen upgraded the stock to "Buy" from "Hold" and raised its price target, citing progress in the company's turnaround plan.

Via StockStory · January 12, 2026

Just over a year ago, the future of SolarEdge Technologies (NASDAQ: SEDG) seemed eclipsed by a shadow of mounting debt, a massive inventory glut, and a plummeting stock price that had shed nearly 90% of its value from all-time highs. However, as of January 9, 2026, the narrative has shifted

Via MarketMinute · January 9, 2026

Shares of solar power systems company SolarEdge (NASDAQ:SEDG)

jumped 5.8% in the morning session after TD Cowen upgraded the stock to Buy from Hold. The firm also increased its price target on the solar technology company to $38 from $34.

Via StockStory · January 9, 2026