NVIDIA Corp (NVDA)

191.13

-1.38 (-0.72%)

NASDAQ · Last Trade: Jan 31st, 6:22 AM EST

Detailed Quote

| Previous Close | 192.51 |

|---|---|

| Open | 191.21 |

| Bid | 190.21 |

| Ask | 190.25 |

| Day's Range | 189.47 - 194.49 |

| 52 Week Range | 86.62 - 212.19 |

| Volume | 179,490,683 |

| Market Cap | 4.64T |

| PE Ratio (TTM) | 47.31 |

| EPS (TTM) | 4.0 |

| Dividend & Yield | 0.0400 (0.02%) |

| 1 Month Average Volume | 162,524,581 |

Chart

About NVIDIA Corp (NVDA)

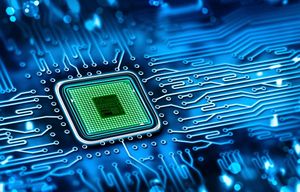

NVIDIA Corporation is a leading technology company primarily known for its innovations in graphics processing units (GPUs) that enhance visual computing across various applications, including gaming, professional visualization, and artificial intelligence. Beyond its strong presence in gaming, NVIDIA's products are integral to deep learning and data center solutions, empowering advancements in machine learning, autonomous vehicles, and high-performance computing. By leveraging its cutting-edge technologies, NVIDIA aims to drive the future of computing and improve experiences across industries, from entertainment to scientific research. Read More

News & Press Releases

Thiel's latest move suggests a change in AI strategy.

Via The Motley Fool · January 31, 2026

There's a lot for investors to like about Meta in 2026.

Via The Motley Fool · January 31, 2026

Nvidia shares could charge higher as artificial intelligence (AI) spending increases across data centers and autonomous vehicles.

Via The Motley Fool · January 31, 2026

A lot can happen in five years.

Via The Motley Fool · January 31, 2026

TSMC founder Morris Chang ended a year-long public absence with a private Taipei dinner alongside Nvidia CEO Jensen Huang, reassuring the semiconductor industry of his sharpness and underscoring TSMC's continued central role as global chip capacity expands worldwide.

Via Benzinga · January 31, 2026

The electric vertical takeoff and landing (eVTOL) market offers huge upside potential, but also downside risk.

Via The Motley Fool · January 31, 2026

The Vanguard Information Technology ETF is missing some key long-term pieces.

Via The Motley Fool · January 31, 2026

Nvidia's proposed $100 billion investment in OpenAI has reportedly stalled as CEO Jensen Huang raises concerns over the AI startup's spending discipline and intensifying competition, prompting both companies to reconsider a smaller, nonbinding equity deal even as OpenAI attracts heavy Big Tech interest and posts surging revenue.

Via Benzinga · January 31, 2026

SaaS stocks have plunged on AI fears.

Via The Motley Fool · January 31, 2026

NEW YORK | January 2026 — When global computing giant CoreWeave announced its strategic acquisition of a controlling stake in Animo in 2025, the capital markets were curious about this company deeply rooted in “virtual productivity”. Today, with the disclosure of Animo’s 2025 core operating data, a grand blueprint for a “Digital Factory” is becoming clear: the extraction of wealth from virtual worlds has officially entered the industrial age.

Via Binary News Network · January 31, 2026

China has conditionally approved DeepSeek and other major tech firms to buy Nvidia's H200 chips, undercutting earlier fears that the low-cost AI startup would reduce demand for Nvidia's high-end processors.

Via Benzinga · January 30, 2026

The booming artificial intelligence (AI) infrastructure business has been a fantastic investment.

Via The Motley Fool · January 30, 2026

After a volatile start to 2026, these three dividend stocks combine strong early momentum, analyst support, and income potential for the year ahead.

Via Barchart.com · January 30, 2026

Reports surfaced this week that Amazon.com, Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI, the world’s leading artificial intelligence laboratory. This potential deal, first reported by major financial outlets on January 29, 2026, marks a seismic shift in the "AI Arms

Via MarketMinute · January 30, 2026

In a week that many analysts are calling a "watershed moment" for the future of transportation and artificial intelligence, Tesla (NASDAQ:TSLA) reported fourth-quarter 2025 earnings that defied the grim expectations of the "EV winter." On January 28, 2026, the company posted a non-GAAP earnings per share (EPS) of $0.

Via MarketMinute · January 30, 2026

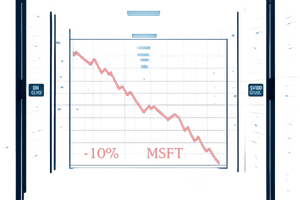

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

MENLO PARK, CA — In a resounding validation of its aggressive pivot toward artificial intelligence, Meta Platforms (NASDAQ:META) saw its stock price skyrocket by 9% in late January 2026. The surge followed a blowout fourth-quarter earnings report that silenced critics of the company’s massive capital expenditure and established the

Via MarketMinute · January 30, 2026

Apple Inc. (NASDAQ: AAPL) delivered a commanding performance in its fiscal first-quarter earnings report on January 29, 2026, shattering revenue and profit records on the back of explosive demand for the iPhone 17. Despite exceeding analyst expectations across nearly every major metric, the tech giant saw its stock price decline

Via MarketMinute · January 30, 2026

In a move that sent immediate shockwaves through global financial markets, President Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on the morning of January 30, 2026, represents a fundamental shift in the leadership

Via MarketMinute · January 30, 2026

Nvidia's stock still has a lot of potential upside.

Via The Motley Fool · January 30, 2026

Intel is back in focus as Apple reportedly looks to use its U.S. foundries, sparking fresh debate over whether INTC stock is worth buying now.

Via Barchart.com · January 30, 2026

OpenAI and Anthropic are expected to have IPOs in 2026, potentially driving up AI infrastructure spending and benefiting companies like Nvidia, Amazon, and Microsoft.

Via Benzinga · January 30, 2026

This artificial intelligence (AI) stock has beaten the heavyweights over the past year and still trades at a very attractive valuation.

Via The Motley Fool · January 30, 2026

Even assuming MI450 arrives on time, AMD stock simply costs too much.

Via The Motley Fool · January 30, 2026

The Conference Board’s Leading Economic Index (LEI) recorded a 0.3% slip in its latest reading, signaling a cooling trajectory for the United States economy as it enters the new year. This downturn, reported in January 2026, marks a pivotal moment for markets that have been grappling with the

Via MarketMinute · January 30, 2026